LIVE! 3-Day Market Challenge with Andy!

25-27 Jun 2025 | 7:30PM - 9:30PM

The World Is Changing Fast.

No Job or Business Is 100% Secure Anymore.

You’ll Either Learn This Now… or Regret It When Your Job Gets Replaced by AI.

No Empire Lasts Forever. No Business Does Either. But The Stock Market Did.

You Don’t Need $100,000 to Start.

(But You Might Need It if You Keep Waiting.)

This Is NOT a Course. It’s a Challenge to Prove How You Can Grow Your Money — Even if Your Starting Capital is Just $500

Date: 25-27 Jun 2025 | Time: 7:30PM - 9:30PM

Date: 25-27 Jun 2025

Time: 7:30PM - 9:30PM

Do You Feel Like Everything Around You Is More Uncertain Than Ever?

especially with DT, markets tend to become volatile and unpredictable…

We’re Living Through the Most Disruptive Era Since WW2. Prices are inflating. Jobs are being replaced. Whether you choose to adapt or not…

You’re already being affected.

But here’s the truth most people won’t tell you:

Every crisis creates the next wave of generation wealth.

That’s Why We Created the 3-Day Bull Traders Challenge

✅ How to trade in Bull, Bear, Sideway Market

✅ How to identify stocks riding the megatrend

✅ How to spot trend setups before the crowd joins

✅ How to position like the top 1% traders — with clarity and confidence

It’s time to stop watching from the sidelines.

⚠️ We’re limiting spots to serious action takers only.

In This Challenge, You’ll Discover:

How to Track Big Players Movements

ride the trend with big players during both bull and bear markets.How to Spot the Next Big Trend Early

before it becomes headline news or too late to profit.The Secret to Earn the Most During Bull Markets

timing your entries and exits with precisionHow to Avoid Overtrading in Bear Markets

protect your capital and wait for high-probability setups while others panic.Risk Management Strategies That Actually Work

regardless of market conditions, so you sleep better at night.When to Take Profit Before Big Players Sells

learn the signs that a rally is done and it’s time to lock in gains.How to Identify a Bull Market Trend Early

position yourself for the biggest upside before the crowd joins in.

In Just 3 Days, You’ll Learn the Skill That Helps You Thrive Even When the World Changes.

No more guessing. No more FOMO.

No more confusion.

Hi, I'm Andy Yew, founder of NDU Systematic Trading System. With 15+ years of real-world trading experience, I'm here to share the secrets of successful investing.

I’ve helped thousands of students ride major trends and recover from tough market cycles. This challenge is built to do exactly that:

Give you the roadmap to ride the biggest trend in stock market.

We’ll show you how to ride the biggest trend of the decade, without needing to be a financial expert. This isn’t about hype. It’s about leveraging real strategies, built on 15+ years of proven results.

Many voices telling you that A.I. is the future,

but have you ever doubted...🤔

💲 How can I benefits from this?

😶🌫️ Is this just a bubble waiting to burst?

🥶 Is it too late to invest in AI stocks?

😯 How to identify the most promising AI companies?

👻 What are the signs of an overvalued AI stock?

🤑 What is the long-term growth potential AI stocks?

🤖 Should I invest in AI ETFs or individual stocks?

👀 How much of my portfolio should be allocated to AI stocks?

For years, I’ve helped investors grow wealth and achieve financial freedom

Spot top-performing stocks and ride the big trends

DAY 1

Stock Trading for Beginners: What Schools Never Taught You

Most people believe that to start trading, you need a lot of money or finance background. But the truth is: with the right tools and strategy, anyone can start, even with a small salary.

Why the stock market is the ultimate skill to learn in today's economy.

What you MUST know before opening a stock trading account?

How to grow with small capital using smart strategies?

Tired of 9 to 5 job? Learn how you can create your passive income by trading in stocks!

The 3 types of income from the stock market.

How To Start Trading Stocks as a Complete Beginner?

How To Grow a Small Stock Account?

The truth is — in the stock market, anyone can participate.

You don’t need a finance degree.

You don’t need to be a full-time trader.

You don’t need 10 years of experience.

In fact, it’s probably the most accessible place in the world to grow your wealth, if you have the right strategy and mindset.

And right now, with this AI-driven bull market taking shape, you're either adapting early... or watching others ride it without you.

DAY 2

From Beginner to Confident Trader: Your Blueprint for Smart Trades & Risk Control

Most beginners lose money not because they’re not smart, but because no one taught them how to enter and exit a trade safely. What if you had a clear, step-by-step plan to spot good trades and protect your capital?

How to read charts easily — see when to buy/sell using simple candlesticks and support lines (so you stop guessing when to buy)

How to spot better trades: Discover how to find strong setups, simplifying your decision-making and boosting your confidence.

How to protect your capital & avoid big losses: Learn how much to buy, where to cut loss, and calculating the reward-to-risk ratio to protect your capital.

❌ Without these skills, most beginners:

Buy at the wrong time, Cut winners too early, Hold losers too long, and burn out before they see results.

✅ With this strategy, you’ll trade with more confidence, know exactly what to do before entering a trade, and stay protected — even with a small account

DAY 3

Secrets of Consistent Winning

Secrets to Grow Consistently — How to Build an All-Green Portfolio That Grows With You

Anyone can get lucky with 1 or 2 trades.

But the goal isn’t luck. The goal is repeatable results.

Spotting Big Trends Early: Learn how to ride long-term trends before the crowd.

From Setup to System: How to build your own trading routine (screening, planning, executing)

Consistency Formula: Low-risk, high-probability trades that compound results over time.

Avoiding the Burnout Loop: The biggest beginner mistakes when scaling up, and how to avoid emotional trading.

The Weekly Plan of a Pro Trader: How top traders prepare even before market opens.

On Day 3, we’ll help you build the habits, mindset, and routines that separate consistent traders from gamblers. We'll also show you easy ways to make a lot of money with low risk in the stock market.

Sounds simple, right? These are the strategies that I have summarized from my 15 years of investment experience, these are the most suitable strategies for everyone to make money consistently, and have been proven by tens of thousands of investors.

When you look back 5 years from now…

Will you be proud you adapted early and took action?

Or regret that you missed another once-in-a-decade opportunity?

Human beings are naturally resistant to change.

Every time something new emerges, whether it was the internet, Bitcoin, electric cars, or now AI, the first instinct is to dismiss it.

"It’s just a bubble."

"It’s too risky."

"It’s not for people like me."

But while most people are still doubting…

those who adapt early are already making life-changing money.

In the Dot-Com era, the winners turned thousands into millions.

In the AI era, we’re already seeing it happen again — fast.

The truth is — in the stock market, anyone can participate.

You don’t need a finance degree.

You don’t need to be a full-time trader.

You don’t need 10 years of experience.

In fact, it’s probably the most accessible place in the world to grow your wealth —

if you have the right strategy and mindset.

What You'll Learn in this 3-Day Challenge

Current Market Trend Analysis

Top-Performing U.S. Stocks

A.I. Related stocks with Potential

How Billionaires Make Billions and How We Can Follow Them

Creating Passive Income and Early Retirement within the next 6 months.

Utilizing Leverage for Increased Returns

Professional Risk Management Techniques

Profiting from the AI Revolution

Low-Risk, High-Reward Investment Strategies

Consistently winning in the stock market

In Times of Uncertainty,

We Find Opportunities to Grow

While Others Hesitate...

While concerns about AI job displacement or market bubbles abound, the past 6 months to a year have shown us real potential and profitability in this trend.

You may worry about "is it too late to invest?"

so we offer more than just insights into the strongest AI stocks, we provide long-term investment strategies, leverage techniques for maximizing profits, and comprehensive risk management plans...

While you might perceive this challenge as solely an "AI-focused course," but actually we covers much more than that...

You may have seen someone say this online...

"I want AI to do my laundry and dishes so that I can do art and writing, not for AI to do my art and writing so that I can do my laundry and dishes."

In fact, we already have washing machines and dishwashers, wouldn't buying these machines help a little? Many people only see the side of AI replacing their creations, but not the side of AI making them rich / retired.

How to Spot Winning Stocks in a Bear Market (Even During Trade Wars)

When the Market Looks Scary…

Just last week, the headlines hit hard:

“U.S. Slaps 24% Tariff on Malaysia in Latest Trade War Escalation.”

Recently, we have made a lot of money in the big trend of AI, US stocks NVDA, Malaysia stocks YTL and YTL Power.

These stocks have risen a lot. Those who have bought them understand the feeling of making money.

In fact, money💰 is just a number. If the person who can help you wash your dishes and clothes only needs USD600 a month, then your job is just to make money from stocks, right?

It's time to change.

AI will replace many people's jobs, but it will also bring huge opportunities.

Now when we talk about AI, it is no longer a simple tool for generating text and pictures, but a revolution that is quietly happening. This revolution will throw your lifestyle and work into uncertainty, investing in the right place is the only and easiest way to benefit from this revolution.

And as if that wasn't enough...

We've Included Bonus Material !

That is Guaranteed to Take your Trading Performance to a Whole New Level.

BONUS #1

The Ultimate Trading Checklist

Gain access to the comprehensive guide that covers every aspect of trading, ensuring you make confident and profitable decisions every time.

BONUS #2

Buy Signal Criteria

(Know when to enter)

Discover the best times to buy and maximize your profits.

BONUS #3

Sell Signal Criteria

(Know when to cash out)

Learn when to sell to secure the highest returns.

Besides, I will unveil with my 15 years of investment experience...

Take these BONUSES

BONUS #1($997 Value)

Real Case Study: From skyrocketing IPO stocks to the global new trend of AI-related stocks...

You will have the opportunity to delve into a series of real-life case studies. From once soaring IPO stocks to today's darling of the global investment field—AI artificial intelligence-related stocks, I will share how I managed to capture these skyrocketing stocks using a simple "Checklist." By following this proven formula, you too can learn to do it yourself!

BONUS #2 ($1397 Value)

In-depth Breakdown of a Multi-Million Dollar Profit Investment Portfolio

Dive into real-world case studies and precise data analytics to uncover the strategies and simple tactics behind lucrative accounts. This segment is more than just imparting investment knowledge; it's an invitation to gain a deep understanding of how we navigate and excel in the fluctuating stock market, especially focusing on current market trends.

BONUS #3 ($897)

Lifetime Access to our Exclusive Private Group

Upon enrollment, you'll be granted lifetime access to an exclusive, private group where you can interact with a diverse group of investors. Whether for strategy discussions, investment advice, or sharing experiences, this platform will serve as a valuable resource for tackling challenges and broadening your investment perspective amidst evolving market conditions.

Total Value: $3291

Ready To Make Some Changes?

Before This Challenge

Uncertain about where to start.

Feeling overwhelmed by the complexity of the financial markets

Unsure about managing risks and maximizing returns.

After This Challenge

Clear understanding of current market trend.

Confident in navigating the financial markets.

Knowledge of risk management and informed decision-making.

Ready to build a diversified investment portfolio.

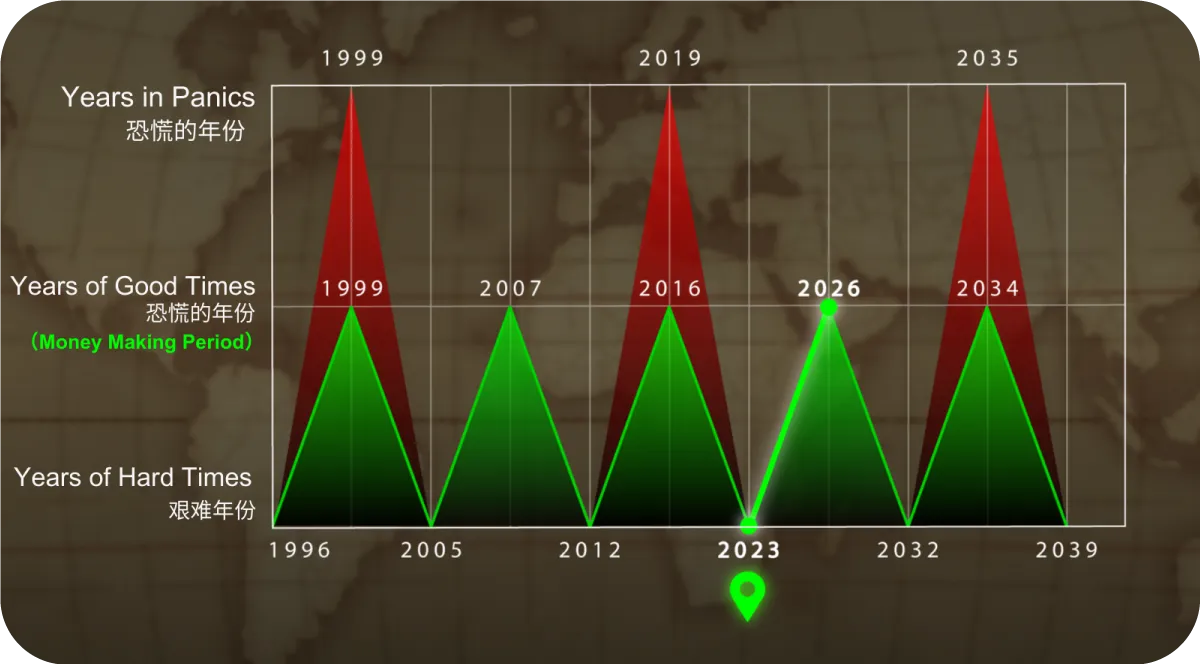

2024: Opportunity or crisis

If you think it's too late and the stock market has already started to run away, you may lose your opportunity. In the stock market, timing is key.

Assuming that 2023 is the turning point from bear to bull... then 2024 will be a very decisive year.

During the MCO in 2020, the global stock market suffered a stock market crash, but it also brought a great opportunity afterwards. Every stock market crash can create a new trend.

I believe that 2024 will be a year of challenges and opportunities, so we choose this timing to deploy with every investors. Only when the opportunity comes, we can ride with the big trend.

I wish you know that

This new online course, can only be attended by you in person....

我希望你能拥有超越其他人的不公平优势。尽管在这个时代,线上教学已经变得非常方便,但由于此次课程采用了全新的模式,所以我希望你能够100%专注于我特意为你准备的这些内容。

我见过太多不赚钱的户口。在股市中,许多投资者错误地将“安全”与“最佳投资选择”划等号,却最终陷入了庄家设置的陷阱,这样血淋淋的例子我看过无数。作为一个拥有15年投资经验的“老手”,我深知只有极少数的人能从股市中赚钱。正因如此,在这场线下课程,我将分享如何抓到股市中10%的好股,无论你是刚入门还是已经有一定经验,都将从中受益匪浅,从容应对股市中的挑战。

关键在于时机,而非股票本身。抓住适当的时机往往比选择股票更加重要。即使是最好的股票,在错误的时机购买也可能导致亏损。因此,我们在这个时机举办了这场线下课程,为的就是让你能够拥有一个很强的基础,在面对2024年即将暴涨的股市,才懂得如何抓住机会进场。

上次《股票投资新蓝图》学员的成功例子就是最好的证明。去年我们举办的线下课程1.0,为到场的学员准备了许多应对“2023熊转牛”的投资策略。而我们的学员也确实证明了我们的策略是有效的!大部分学员都在股市一波小暴涨中赚到钱。这一次,为了应对2024年的“熊市逆袭”,我们已经准备了全新的模式等你解锁!不夸张的说:你来一天=拥有了十年的经验。

Continuing scrolling won't reveal the answers... unless you start taking action.

Catch it Now or Never..

For the past 15 years, I've predominantly been trading my time for money. That changed dramatically when I caught my first Big Trend. We all know the hardest part is taking that first step from zero; but once that's achieved, the second, third, or even the 58th step becomes significantly easier.

Let's get straight to the point: I'm someone who thrives on sharing because it simultaneously propels my own growth. Honestly, the challenges you're facing with investing right now, I've probably been through them before.

If you're ready to make a change and take that first step now, then click the button below.

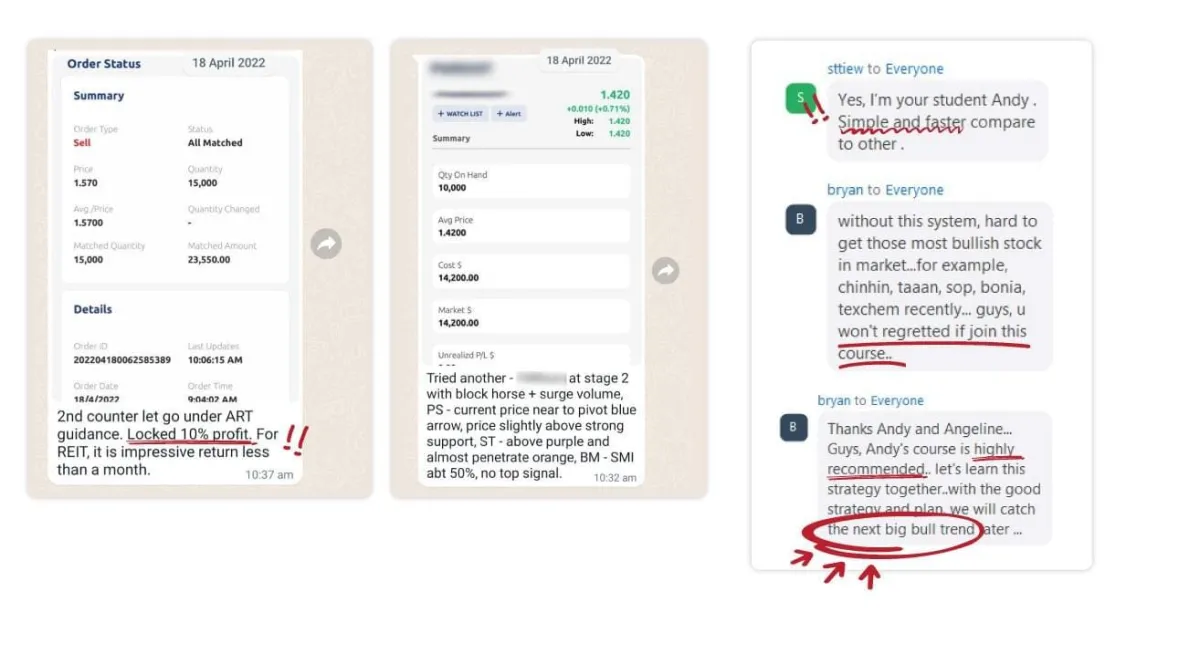

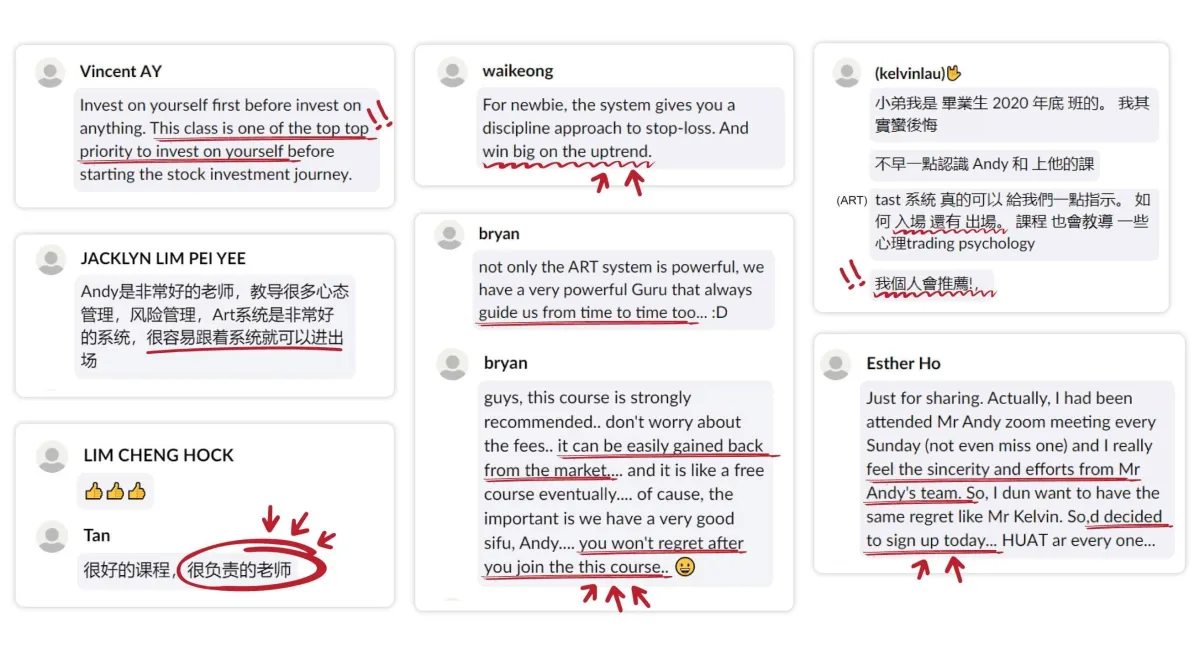

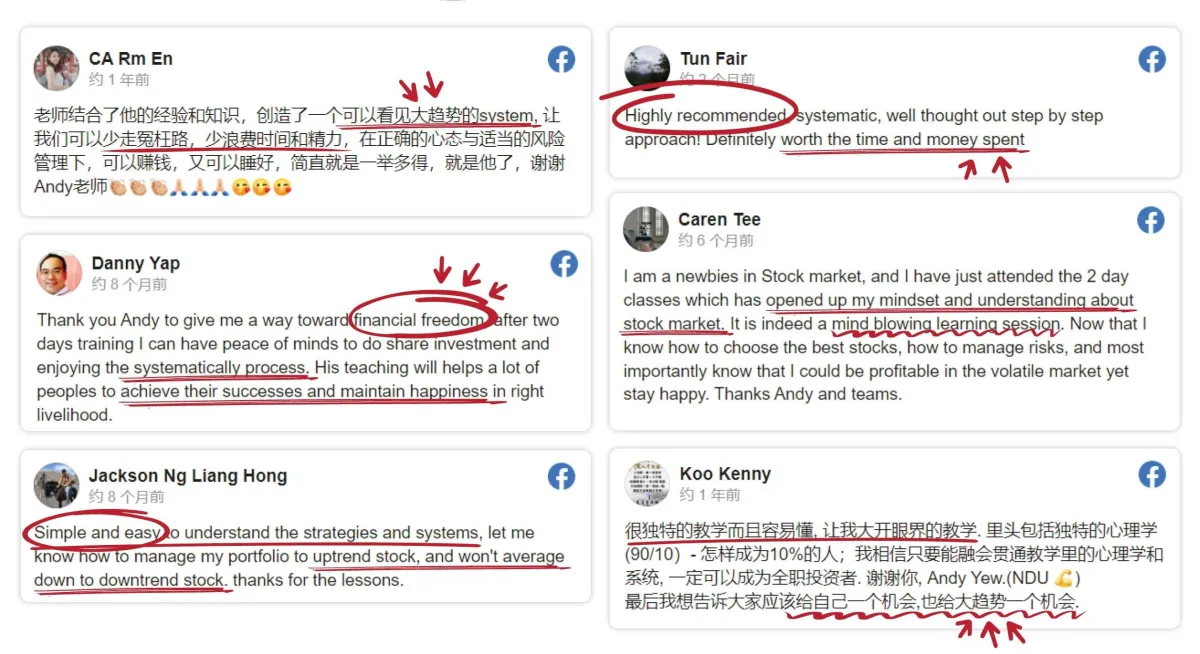

Here are what our students said about in the last event…

"After I started using Andy's program, I was able to make 30% ROI.... WOW... it's really a good result!"

GIM

Freelance Dancer

"I should come here 20 years ago, so that I could have save my time 10 years ago! I will encourage everyone to come attend Andy Yew's class, you will save a lot of hassles."

Investor

How a 50 years old Accountant Make1 Million Profits less than 6 month!

SEW

Accountant

"Trading doesn't stop, making money doesn't stop."

How Chin Fern Trades Around the World Without Giving Up Her Freedom

Chin Fern

JUJU Restaurant Business Owner

(former air stewardess)

"The event was amazing, they had organized it in a very professional manner, managed in a very systematic way. I would definitely be looking for the next event!"

Mukesh Chainani

Investor

“Trading became something meaningful, because I get to do it with my daughter. Now both of us are trading, we have the same common topic, and we profit together, that's the most wonderful thing!"

Maryirene

Retiree

"I realized that stock trading can be so simple even if you have no experienced"

Stephanie

Finance Industry

"In school when I learn about economics, everything is theory wise, going to a this course allows me to apply it practically. We need to find a good like teacher,like Andy Yew."

Emily

High School Student

"They should be organizing such more events so that our community which is doing the investment get benefited from that."

Investor

"They makes it easier for beginners as they don't put too much different indicators on to the trade, complicating the charts. So it helps you to decide fast, which I think is a key into trading."

Investor

"It's very easy for beginners to get familiarized with the system. If you do not have a lot of time to spend to study technical analysis, then get this system, it's good to help you pick stocks quickly!"

Elaine

Accountant

"During my last two to three years course, I discovered a lot of things. Where the things unsolve, unknown, then I finally get the answer from him."

Isaac Khoo

IT Specialist

"If you don't know how to manage your risk, then you're not supposed to be in the market. You don't have to guess which will workshop to go to, because Andy teacher had put it very simple for you. He has created a very simple system, it helps you to make very fast decision."

"So far to our surprise, we managed to make $1,000 every month, and my last profit is around $1,800. I've been trading for more than 10 years, and unfortunately I can't make a kind of consistent profit, until I get to know Andy and his software."

GK

"When you feel regret, that is the time you should take action" Wow! This really inspired me! We cannot follow the 90%, we must be the 10%."

Dr Koay

Featured with World-class Trader Tom Basso in SGX

It was a valuable and inspiring session that brought great value to our trading community.

★★★★★

“

You don't have to hunt for news. I encourage everyone who aiming to profit in stocks to join this course. It could offer better guidance, saving you from needless detours.

Oil & Gas Industry

“

We all think that stocks which have already risen are too high to enter, and they look for ones that haven't risen yet. But this mindset needs to change.

Businessman

“

The system really helpful. Now I can filter which stocks to buy. Andy is amazing because he can create such an easy and effective system for everyone.

Marketing Director

“

If you don't attend classes or study and invest, how can you make money in the stock market? That system really is helpful, it's clear and easy to learn, everyone can learn it.

Retiree

“

His course is well-designed, and he's continuously improving and innovating, always adding useful insights in line with the market. He's put in a lot of effort. Well done, Andy!

Investor

“

Trading is a great investment opportunity, but without attending classes, you're bound to lose money. At least by attending classes, you gain understanding, and Andy will provide you with a systematic way of managing your portfolio, giving you the confidence to engage in trading

Retiree

“

Andy can give you a great start on how to invest in stocks. With his guidance, you can find your financial freedom in the stock market and learn a systematic approach to buy & sell stocks.

Network & Communication

“

In the early stages of investing, we often encounter many obstacles. However, here with Andy's system, we have the opportunity for entry and exit points. With just a few clicks, we can select the best stocks.

Electrical Contractor

“

Sometimes, you can get confused by online news and stock tips. Joining Andy's class helps you avoid many pitfalls. You won't invest blindly anymore; instead, you'll follow a proven system to profit in the stock market.

Engineer

Are you ready for the next BIG TREND?

Who is suitable for this challenge?

People who are new to Stock Market

People who want to make more money

People who want to Leveraging their Portfolio

Individual Investors

Finance Professionals

Investors Seeking to Adapt to Market Changes

Entrepreneurs and Business Owners

Financial Students and Academics

Seekers of Diversified Investments

Active traders

Who are looking for advanced trading tools and techniques to improve their portfolio performance.

Experienced investors

Who are interested in diversifying their investment strategies and want to access multiple trading systems in one platform.

Investors who are interested in technical analysis

And seeking a more data-driven approach to investing.

Individuals

Who are interested in taking control of their financial future and want to explore new ways to maximise their returns.

Beginners

Who want to learn how to manage their money effectively and discover new ways to grow their savings over time.

Passive investors

Who are seeking diverse investment options to achieve long-term financial goals.

Andy Yew

Founder of NDU System

Top Award-winning Stock Broker

Author of 'Win Big Lose Small'

Singapore Licensed Portfolio Manager & Investment Coach.

Award

2014、2015 Best Performance Award

2017 Top ETF award

2013-2018 Top 10 CFD Specialist Award

2017 Bursa Gold Trophy

Andy Yew, founder of the NDU Trading System, is a top award-winning stock broker turned licensed portfolio manager. His systematic and simple trading system helps investors achieve "win big and lose small" by identifying market trends and big players, ultimately turning losses into gains and enabling financial freedom. Andy has won multiple awards for his performance, and is a sought-after speaker and media commentator on market outlook and selected stocks.

Join the 3-Day Challenge for just USD$3

25-27 Jun 2025 | 7:30PM - 9:30PM

OneBigTrend Pte Ltd | 1 North Bridge Road, High Street Centre, Singapore 179094

This program is for educational purposes only. All investments involve risk.

Participation fee: USD $3. Optional upgrades available.

We are not affiliated with any government body or regulator. Any platform examples are used for illustration purposes only.

DAY1

星期四10Nov

7:30pm - 10:30pm

我们将深入分析宏观经济因素和市场趋势,了解全局背景对股票投资的影响。案例研究将帮助您认识历史上各个熊市后涌现的新兴板块和领域,如科技公司(AAPL、MSFT)、互联网时代(GOOGL、NVDA)、电商领域(BABA、AMZN)、电子车(TSLA、NIO、LI)等,以更好地抓住未来发展机遇。

在这一部分,我们将培养投资者的创新思维和灵活性,以应对日益复杂多变的市场情况。您将学会如何看待投资中的新问题和挑战,并发掘潜在的投资机会。

• 通过国际视角教你如何去看待整个股市的趋势,宏观经济• 提升你的认知能力,让你不再局限于熊市的痛苦• 学会全球化的投资技巧

DAY2

星期五11Nov

7:30pm - 10:30pm

• 通过国际视角教你如何去看待整个股市的趋势,宏观经济• 提升你的认知能力,让你不再局限于熊市的痛苦• 学会全球化的投资技巧

DAY3

星期六12Nov

9am - 5pm

• 解剖过去十年股市里“暴涨股”的模式 • 抓到下一只改变命运的“冠军股”的技巧和秘诀• 学会分辨股市表现最佳的10%股票

• 独特教学方式教会你快速辨别股市里真正会“跑”的股票 • 找出能翻倍的新趋势板块、股票• 看透大牛趋势股图,成功避开劣质股• 独创ARTS投资策略,股票翻倍前的量价Checklist

Q&A

为什么一定要参加这次的《股票投资新蓝图3.0》New Stock Market Blueprint 3.0?

有危机才有转机,有熊市才有牛市,改变人生的大趋势往往都是从熊转牛的转折点诞生。

请问下一场是什么时候?

这次是我们举办的2023年唯一一场线下课程,可能短期内不会有下一场。

请问资金大小是否有限制?

不管是大的户口或小的户口,都适合学习这个策略,在熊转牛的转折点找大趋势的股票

请问参加过NSMB1.0及2.0的学员可以再次报名参加课程吗?

可以。市场每天都在改变,这次老师所准备的课程内容&应对策略都是全新模式,以现今的股市趋势所调整,欢迎新旧朋友一起学习进步!

为什么会举办这次的线下课程?

2022年股市下跌让不会出场的股民输了好多钱,上一次的我们在《NSMB 1.0》及《NSMB2.0》帮助了许多参与的学员找到了股市中的大趋势,也为我们带来了10年一次的机会。接下来会有很多很多的爆涨股,如果你还是用着保守的方法买股票,可能会错过一个大好机会。

如果不确定能不能出席怎么办?

那就要等下一次我们又再举办《股票投资新蓝图》课程 ;)

为什么要收费?

在这个课里老师会回答到很多投资上的重要问题,所以我们希望可以来上课的人都是真的认真想要一起学习的人。而且我们也有限制一定的人数以便让大家有一个更好的学习环境,所以座位非常有限哦~ 只传有缘人哦!

住宿问题?

想参加此次课程但距离太远?我们可以帮你解决住宿问题哦,请PM我们的团队了解更多。 0124307851

为什么会有Zone C?

由于这次的门票反应是出乎意料的受欢迎,经过一番讨论决定特别加场,开放Zone C给还来不及报名的朋友。但是要注意Zone C开放的名额不多哦,所以请尽快抓住这次机会。之前报名的朋友全部都在Zone B。

NewStockMarketChallenge by Andy Yew

©2025 - All Rights Reserved

Disclaimer

Please note: The regular price of this introductory challenge is USD $288. However, as part of a limited-time special offer, we are offering it at USD $3. This promotional price is only available while seats last and will not be extended once fully redeemed.

All information, content, and materials provided by us are for general reference and educational purposes only. Our information does not constitute any investment advice. We do not provide any consulting services regarding financial or trading advice. You should consult your stockbroker, investment advisor, or any relevant individual for their opinions before deciding to enroll in our courses. Ultimately, you should make the final decision based on your circumstances and risk assessment, and you should bear all risks and consequences.

By enrolling in the course, you acknowledge and understand that our course cannot guarantee any outcomes for your future life, investment path, and wealth; results depend on your efforts and dedication. We do not encourage our students to believe in get-rich-quick schemes or erroneous investment concepts. We believe that everyone can achieve their investment goals through their efforts, abilities, and strengths. If you utilize the knowledge learned in the course and diligently practice it in your investment journey, we believe you can achieve your goals; conversely, if you are unwilling to exert effort or try to change, even if you take our course, the results will remain the same, as there is no free lunch in the world.

According to regulations, we cannot guarantee what results you will achieve after completing the course; outcomes vary from person to person, as not everyone absorbs knowledge equally. Therefore, we hereby declare that we do not assume any responsibility for any loss, claims, or damages caused by this information.

We reserve the right to use your likeness, photographs, videos, interviews, etc., taken during the event (including online or offline) for commercial promotion and marketing. All content/materials presented in the event are protected by copyright law. Participation in the event indicates that you have an "established business relationship" with us, and therefore, we have the right to contact you via telephone, mail, or email for future events and promotional activities.

ALL COURSE MATERIALS CONTAIN CONFIDENTIAL BUSINESS SECRETS - REDISTRIBUTION IN ANY FORM WILL BE CONSIDERED A VIOLATION OF YOUR ATTENDANCE TERMS/CONFIDENTIALITY AGREEMENT AND COPYRIGHT LAW.

NewStockMarketChallenge by Andy Yew

©2024 - All Rights Reserved

来看看全球各地三百位客户管理六千五百万美元以上资金的Tom Basso(《轻松致富》作者)是怎么评价Andy老师...

I have been around the block a few times in the investing arena and have seen a lot of ideas and read a ton of books. After reading Andy’s new book Win Big, Lose Small, and carrying on an email conversation with him, I realised he had taken the overall concept of trend following, added some of his own concepts, and made the combined result his own strategy.He emphasises letting winners run and cutting losses short, a maxim followed by so many good traders over the decades. One very large profit can pay for many small losses, so managing the risks and losers becomes extremely important.Andy’s philosophy towards ignoring the news and maintaining your happiness is like my own. I try to keep my emotional balance as neutral as possible. Being too excited with a big winner or being down over a recent loss is not helpful to good trading, and he captures that very nicely. In my opinion, the mental advice in this book is excellent.His examples and stories make it an easy-to-read book on investing. Everyone who reads it should come away with one or more good ideas to try in their own trading. Enjoy the read and the ride!Tom BassoFormer President, Trendstat Capital Management, Inc.Founder, enjoytheride.world (an educational website for traders)

Win Big Lose Small is the ability to trade consistently in any Market; whether it's US, Hong Kong, China, Singapore or Malaysia to pick the best performing stock in the market, have most of your money invested, and sit back while the profit roll into your trading account.

This is a highly specialized skill that many Bankers, Traders and Investors have been trying to figure out.

To be clear, this book is not about Technical Analysis or Fundamental Analysis. You can properly learn how to do that for free on the internet or in school. There is a huge difference in Analyzing stock and actually picking and trading stock that give you high probability win rate, consistent performance and most importantly... a good sleep at night.

Andy Yew

Andy Yew (游俊昌) is a top award-winning stock broker turned licensed portfolio manager. He is the founder of the ART Trading System—a systematic and simple trading system that helps him and many others to catch the trends and identify big players in the market without looking at complicated indicators and financial reports. As a stock broker with one of Singapore’s largest privately owned global financial advisories, he has won the Best Performance Award in 2014 and 2015, Top ETF award in 2017, Top 10 CFD Specialist Award from 2013 to 2018 and the Bursa Gold Trophy in 2017.

In addition to a successful trading career, Andy’s speaking engagements include sharing sessions at ShareInvestor, 93.8Live, CITYPlus FM and Capital 95.8FM 城市频道, where he shares his professional views on the market outlook and an array of selected stocks. Andy has also been invited for interviews with MediaCorp Channel 8’s Money Week (财经追击).

What if it could help you or your parents to retire early, give you more choices in life or the freedom to be where you want to be?

You can only achieve the dream if you knew how to trade, inspire and monetize from that expertise.

Win Big Lose Small will help you to Find the Big Trend and give you clarity on how to identify the best stock in the market

Win Big Lose Small will show you how to maximise your winner and profit without being stressed, worried or emotional

Win Big lose Small will teach you how to minimise your loss through the process of a professional money manager

"Andy Yew has written a book that captures the keys to profitable trading in one place. Listen to Andy, if you want to win big then you have to lose small!"

Steve Burns

NewTraderU.com

"Trading is both an art and science. Andy is well-versed in both aspects. Clients trust him to help them become better traders. If you want practical advice trading the markets, look no further!"

Luke Lim

Managing Director at Phillip Securities Pte Ltd

"An excellent step-by-step guide to the basics, as well as the complexities, of personal investment. This book educates stock investors the common mistakes made and how to avoid them by having a good trend following system. A must read for stock investors"

Daniel Loh

DL Investment Director

“Winning big and losing small is the ultimate goal of every investor. This book revisits the fundamentals of investment strategy and presents a different investor mindset that could change how you work. An interesting and essential read for whoever aims to be an outstanding trader!”

Gao Yixin

Senior Producer-Presenter, Capital 95.8FM

Andy is a specialist when analysing the smart money movement in the stock markets. This book contains his inner thoughts on beating the stock market by using his proprietary smart money index.

Ng Ee Hwa

ChartNexus Director

"Investing is a lifelong pursuit and a very personal journey. Many investors swear by their own style of investing and often dismissed everyone else's success as mere luck. Andy has shown from his own personal experience and research that only 10% of the people will consistently make money in the stock market. However, this does not mean that all 10% of these winners are using the same strategy to be successful in the market. In fact, the success in investing is not really about the stock you buy but rather on your investing system.

As he mentioned, this book is not about technical analysis or fundamental analysis but rather it is about sharing how we can learn from the mistakes and success of others and incorporate these lessons to form our own investment system. If you are just starting out in investing, Win Big Lose Small is a great book to help you get started and avoid many of the mistakes that occur in the market every day. Only through continuous learning can we form an investing system we are confident in following consistently for our entire investing journey. This book will definitively show you how to start that journey."

Stanley Lim, CFA

Co-Founder of Value Invest Asia

Co-Author of "Value Investing in Asia"